Get your medical marijuana card in Illinois

More than 150,000 patients evaluated over 8 years

Benefits of getting an MMJ card in Illinois

Higher purchase and possession limit

No age limit

Employee protection

Legal protection

Lower prices

Home growing permission

Get your medical cannabis card in 4 easy steps

To start the evaluation process, complete a short, confidential questionnaire on our website. Complete the secure payment process to complete your order.

Schedule an online consultation with an Illinois-licensed physician authorized to recommend medical cannabis. The doctor will check whether medical marijuana is suitable for you.

Create an account with the Illinois Cannabis Tracking System, select MCPP Patient Registration and complete the application with your passport-style photo, proof of Illinois residency and government-issued ID. Pay the $50 annual fee.

Await approval from the Illinois Department of Public Health which may take up to 30 business days. If approved, you receive a medical marijuana card within 15 days.

Do I qualify?

Dr.Weedy prices are final

Prices for getting a medical card in Connecticut

competitors

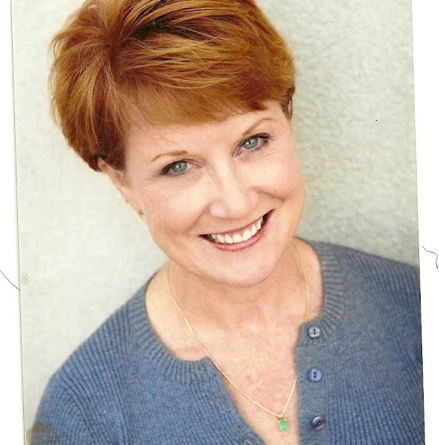

30+ state-licensed physicians at your service

Patient stories: cannabis therapy successes

Live emotions of our happy clients

«Hey everyone, I just want to give a big shout out to Dr. Weedy for doing such an amazing job of helping me get my medical marijuana card. You know, a lot of times you go to these different websites and it takes a very long time to get approved or get a recommendation. And with the help of Dr. Weedy, I was able to get approved very fast for my card. So if you guys are looking for a great evaluation that’s very fast and convenient for you, all you got to do is go to their website Dr. Weedy and they will definitely help you out and do a tremendous job for you just as they did for me. So, thanks again, guys, thank you Dr. Weedy, and I look forward to seeing your success. Full video»

Current cannabis laws in Illinois

Access crucial insights on state requirements and laws regarding cannabis

Frequently Asked Questions

What documents do I need to provide for a medical marijuana card application?

The documents needed for a medical marijuana card application in Illinois include a Health Care Provider Certification, passport-style photo, proof of Illinois residency, a government-issued ID and proof of payment of the state application fee. When applying with a caregiver, the caregiver provides a proof of identity, caregiver attestation form, and proof of payment of the fee.

What is the cost of a medical marijuana card in Illinois?

To apply for a medical marijuana card in Illinois, you first need to obtain a Health Care Provider Certification. Dr. Weedy offers an online evaluation for this certification at a cost of $99, with a guaranteed refund in case of denial.

Once you have your certification, the application fee for a medical marijuana card in Illinois is $50 for a one-year card, $100 for a two-year card and $125 for a three year card. Veterans and patients enrolled under the Supplemental Security Income and Social Security Disability Income get discounted marijuana fees.

Do I need to be an Illinois resident to get a medical marijuana card?

Yes, you need to provide a proof of Illinois residency before receiving a medical marijuana card. Caregivers must also provide a proof of residency in the State of Illinois.

Can I grow my own cannabis in Illinois?

Medical marijuana patients can grow up to 5 cannabis plants no more than 5 inches tall in their home. The marijuana plant must be locked and invisible to the public.

However, recreational users are not permitted to grow cannabis for personal use. Only registered medical cannabis patients are legally allowed to cultivate plants in their residence.

Do I pay taxes when buying cannabis in Illinois?

In Illinois, both medical and recreational cannabis are subject to taxes, but the rates differ significantly. Medical cannabis is taxed at a reduced rate similar to other qualifying drugs. Medical marijuana patients typically pay a sales tax of between 1% and 3% depending on the municipality.

Recreational cannabis, however, is taxed at much higher rates. The state imposes a 10% excise tax on cannabis with a THC level at or below 35%, a 20% excise tax on all cannabis-infused products, and a 25% excise tax on cannabis with a THC level above 35%. Additionally, these excise taxes are on top of the standard 6.25% state sales tax and local taxes, which can be up to 3.5%. Depending on the product’s THC content and local tax rates, the total tax at the register can range from approximately 19.55% to 34.75%.